Following a prolonged pause, M&A is returning to the events sector, providing an opportunity to assess the emerging themes from recent activity and compare these with pre-pandemic deal characteristics.

We have conducted an analysis based on a sample of 100 events M&A processes between 2014-21. Looking at factors such as price, target characteristics, and deal completion rates, we can see significant shifts since 2019 in several areas.

The effect of the pandemic on events M&A

While COVID-19 continues to create bottlenecks for deal-making, M&A fundamentals remain strong. The greatest challenge at present is agreeing on valuations in an environment where event profits have become unpredictable. However, we expect this tension to resolve itself in the next six to 12 months as events trade on their regular cycle and re-establish profit patterns.

The exhibition model remains highly coveted for its predictability, high margins, cash generation and, in the right sectors, growth. Nonetheless, we see organisers emerging from the pandemic with an ongoing interest in one-to-one models and a refreshed enthusiasm for content-rich models. Investor focus on the US market and tech-related sectors strengthened during the pandemic – a trend we expect will continue.

Valuation

While volumes are still too low to discern an exact trend, except for distressed deals, it is clear that sellers’ price expectations have not significantly changed since 2019.

On the buy-side, the number of active acquirers remains healthy but their average activity level is still below 2019 levels. (Activity level is defined here as the number of targets under active review in a given period). Furthermore, there is significant reluctance to value off 2019 EBITDA.

Thus, the demand side of the price equation is unlikely to support pre-pandemic valuation levels in the near term. This dynamic may also be feeding through into the number of processes that successfully complete.

Deal structure and dynamics

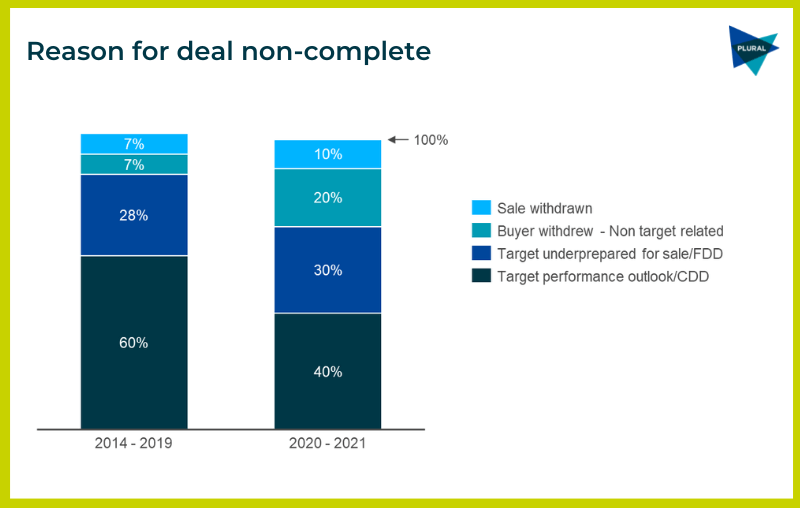

Since M&A activity has restarted, a notable change is a jump in deal failure rates.

This is partly attributable to the reduced proportion of brokered deals, as these have enjoyed a significantly higher success rate overall (71%) vs direct approaches (48%).

However, when examining reasons for non-completion, we see a shift away from target-related factors and towards buy-side factors. This does not include processes abandoned as the pandemic struck; these processes commenced in 2019.

These factors do not relate to an assessment of specific targets. Instead, they speak to a more generalised dilution in buy-side confidence, driven by uncertainty over industry recovery and acquirers’ near-term trading outlook. As the industry recovery continues, we expect these trends to revert to pre-pandemic patterns.

Also related to a more risk-averse buy-side environment, we are seeing increased use of risk-sharing partnership-driven structures, including earn-outs and joint ventures, rather than outright acquisitions. Again, we expect this trend to soften as trading conditions normalise.

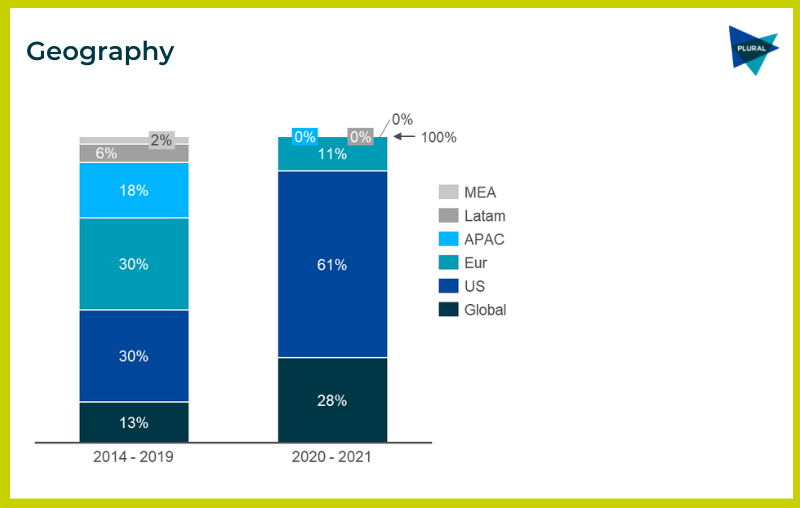

Geography

Target geography is one of the more notable changes since 2020, with a significant increase in US focus since 2020.

The focus on the US can be partially explained by factors that existed pre-COVID:

- the size and long-term growth of the market;

- the degree of fragmentation; and

- availability of private targets.

By contrast, the share of public sector ownership in EMEA and Asia is high. Following COVID, the US has also re-opened more rapidly than Asia, supporting higher investor confidence. However, we also believe the US to be favoured because of its heavy exposure to verticals and models increasingly targeted by acquirers.

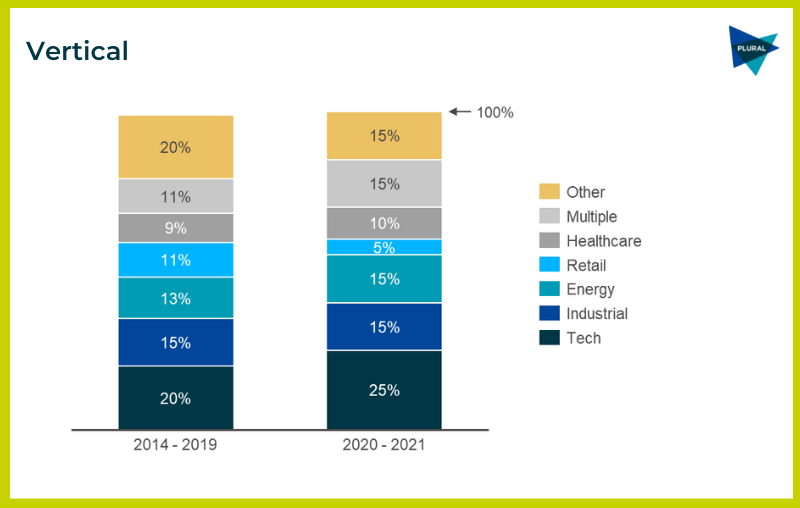

Verticals

A comparison of target verticals across both periods shows remarkably little movement.

- Technology was already the most favoured vertical pre-COVID, having grown steadily since 2014 (our tech deals volume doubled in the 2017-19 period vs the 2014-17 period). We believe continued growth is likely, reflecting strong underlying growth in a wide variety of established and emerging tech sub-verticals addressable by events.*

- Equally, the momentum toward Healthcare, and away from Retail, was established pre-pandemic, reflecting respective structural sector trends.

In each case, COVID’s impact on the respective underlying verticals may have helped to accelerate these trends.

*Note: We have defined Technology events as those primarily featuring software suppliers. e.g. Fintech, Martech, HR Tech, Cybersecurity, AI, Big Data etc.

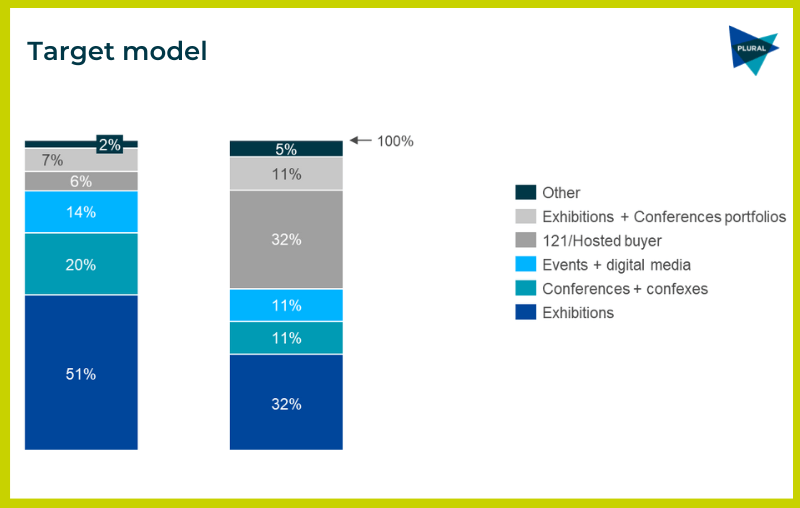

Target model

Comparing asset type and event models reveals a more significant change – most notably an increasing interest in the one-to-one/hosted buyer model.

In the 4th quarter of 2021 alone, Clarion, Tarsus, Hyve and CloserStill all made significant investments in this model. For Clarion, this was the second one-to-one deal in two years.

Growing interest in the one-to-one model is likely to be driven both by tactical considerations as well as more strategic rationale:

- Although one-to-one models lack the long-term predictability of exhibitions, they did prove relatively resilient and 2020 and 2021 as the experience can often be replicated online relatively easily. Thus, one-to-one events offered a degree of insurance against further disruption.

- Secondly, there is a deepening appreciation of the targeting capability a hosted buyer model offers and how the data architecture and set of processes behind it can be applied to a traditional exhibition business. In general, hosted buyer businesses require a deeper knowledge of their buy-side customers than their expo counterparts and a more sophisticated taxonomy. However, Covid highlighted the shortcomings of the traditional expo approach to attendee data, in particular how it limits the business’s ability to develop compelling complementary digital offerings to the attendee base.

For a similar reason, we believe organisers are likely to examine content-driven and digital models with renewed enthusiasm, although this is not yet reflected in the data shown above. In part, there is a realisation that medium-agnostic businesses can be more resilient than a pure-play exhibitions business. Additionally, as with the one-to-one model, the customer understanding and product development potential offered by some digital models make these assets less likely to be viewed as dilutive than pre-COVID.

Structural shifts

Overall, M&A characteristics in the events sector show some notable shifts since 2019.

We expect some of these to be shorter-term adjustments to temporary market conditions. Others appear to indicate a structural reorientation towards models and approaches that organisers see as either complementary to the traditional expo model, or offer potential routes to drive enhancements to their operations.