In a week that sees yet another major Private Equity investment in the trade show industry, Jonny Baynes, head of the Events practice at Plural Strategy Group, explains the current surge in deal-making and predicts more to come.

With the news this week of Charterhouse Capital Partners making an offer for a 50% stake in Comexposium, the world’s fourth-largest trade show organiser, private equity interest in the exhibitions market appears at an all-time high. Four major deals have already been completed in the UK market in 2015, including:

- LDC’s acquisition of the NEC (the UK’s largest events venue)

- Providence Equity Partners’ acquisition of Clarion from Veronis Suhler Stevenson

- Inflexion purchasing a minority stake in CloserStill

What is driving this trend?

There appears to be a combination of three factors at play:

- An attractive business model,

- Apparent immunity from the disruption affecting other traditional media forms, and

- Positive market dynamics.

An attractive business model

Firstly, the exhibitions business model is highly attractive to financial investors. Organisers are highly cash generative, particularly as exhibitors often pay for their stand months in advance. Furthermore, large exhibitions tend to achieve high levels of profitability (60-80% gross margins) due to economies of scale and robust pricing power. Margins are typically consistent as leading shows benefit from loyal customer bases and significant barriers to entry. Exhibition organisers also typically own their intellectual property (the show brand) and require very little in the way of capital or fixed assets.

Apparent immunity from disruption affecting other traditional media forms

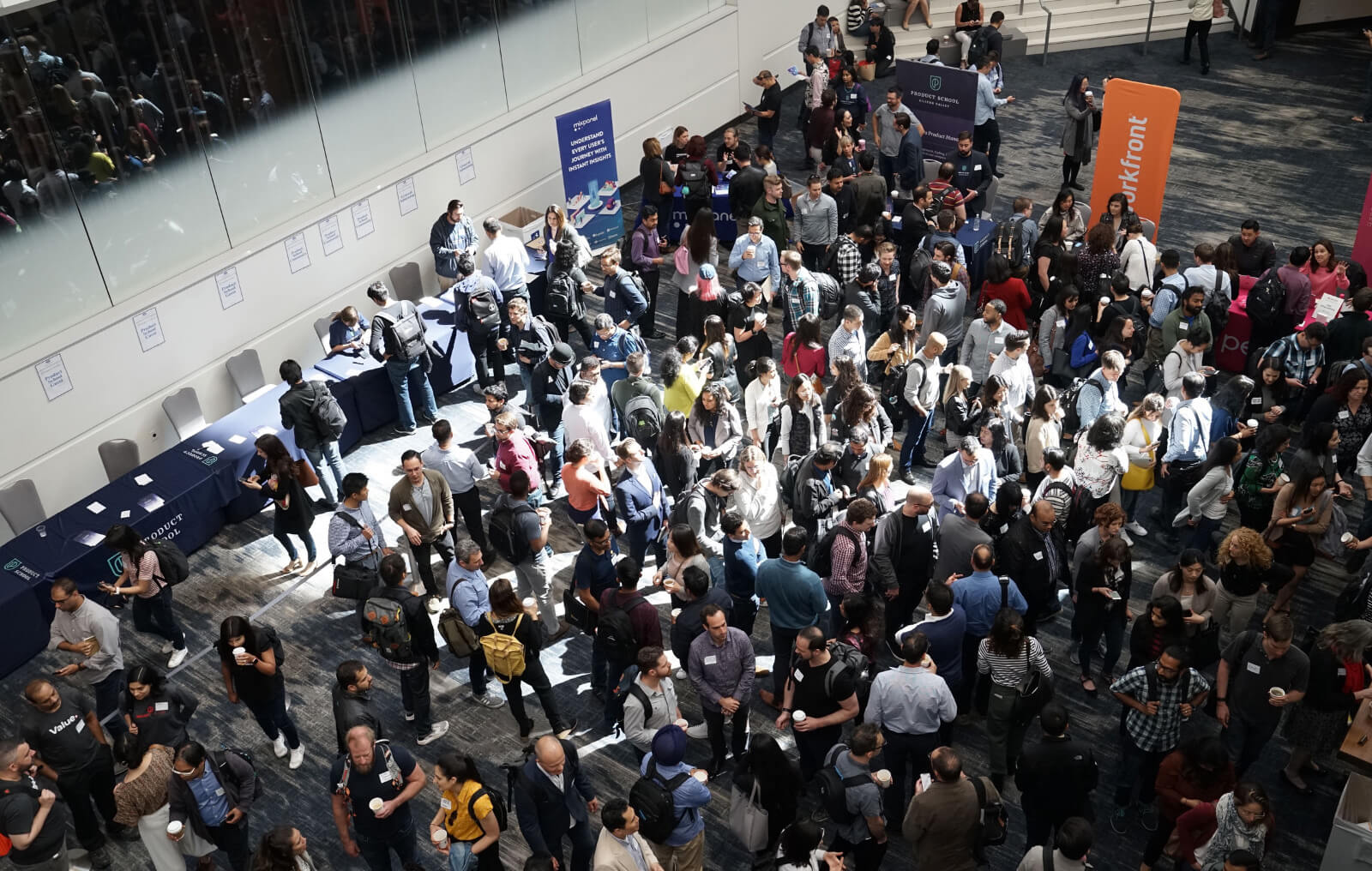

Structurally, trade shows and events have continued to thrive in an era when all other ‘old media’ formats have been disrupted by new digital technologies. It is clear that the desire for brands and marketers to engage face-to-face with their customers is stronger than ever. This fundamental customer need has driven a strong recovery from the downturn, with the global exhibition market outpacing GDP growth every year since 2011.

Market Dynamics

Underlying growth is supported by attractive market dynamics. The combined revenues of the top ten organisers represent less than a quarter of the global market size. This fragmentation means acquisition-driven growth is a common feature of the market. Onex’s acquisitions of Nielsen and GLM to create Emerald Events, the largest US-based for-profit organiser and the leader in the retail events sector, is one such example. The large number of global players fighting to consolidate the market also means there is no shortage of potential buyers when a PE firm is looking to exit – as demonstrated by several recent exits to trade buyers in the US market (VSS selling Advanstar to UBM as well as Informa buying two PE owned assets – Hanley Wood and Virgo).

What is next?

Other PE-owned assets may still come up for sale in the short-medium term, such as i2i (formerly EMAP events, currently part of the Top Right Group, owned by Apax and Guardian Media Group). However, the most intriguing is the potential knock-on effect of the NEC and Comexposium transactions, where the PE industry seems to have found a way to strike deals with public and non-profit owners (the former sold by Birmingham City Council and the latter requiring agreement from the Paris Chambers of Commerce, owner of 50% of the shares). For decades, public and industry ownership of major venues and trade shows has been seen as critical to the economic health of host cities and local businesses. In continental Europe the majority of venues (and their event organising divisions) are in public hands, and in the USA an estimated 85% of trade shows are run by industry bodies.

If we are witnessing the beginnings of a new trend – where public and non-profit owners embrace the potential benefits that PE funds can bring – the surge in deal-making is only just beginning.